Contractor paycheck calculator

To alleviate some of your anxiety we designed a freelance income tax calculator for all types of 1099 workers. All Services Backed by Tax Guarantee.

Paycheck Calculator Online For Per Pay Period Create W 4

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

. The self-employed independent contractors and freelancers. Contractor take home pay calculator Calculate your take home pay using PayStream Use our calculator to get an estimate of your take home pay Whether youre a contractor that is working. Ad Trust One Platform To Compliantly Pay Independent Contractors.

Contract pay calculator Being a contractor has many legal and financial benefits over being an employee as well as a sense of independence. Contractor Calculators We have designed a series of contractor calculators to help work out your tax liabilities. A Simple Flexible Workforce Solution So You Can Focus on Your Day-To-Day Business.

Just input your estimated contract hourly rate and the contractor. Give your employees and contractors W-2 and 1099 forms so they can do their taxes The calculator above can help you with steps three and four but its also a good idea to either. This calculator will show your gross annual revenue as well as your.

Get 3 Months Free Payroll. Ad Compare This Years Top 5 Free Payroll Software. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

The deadline for getting a Form 1099-NEC to a. Fast Easy Affordable Small Business Payroll By ADP. The Off-Payroll IR35 legislation is a reform to IR35 that was introduced in the public sector in April 2017 and which has been subsequently planned to be extended to the private sector in.

For example if an employee earns 1500. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. However contractors incur costs employees do.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This tool has been built to help those who are considering a move into the contract world get a feel for their take-home pay. Generate your paystubs online in a few steps and have them emailed to you right away.

Heres the formula to use to. There are two formulas you may use for calculating a contractor rate. Paycheck Calculator A perfect calculator for the independent contractor to figure out what their take home pay is going to be after taxes.

Get 3 Months Free Payroll. Ad Create professional looking paystubs. The first involves determining the rate to pay contractors by the hour.

Next divide this number from the annual salary. Just enter your gross pay pay period filing status. Ad Learn How To Make Payroll Checks With ADP Payroll.

We use the most recent and accurate information. The umbrella calculator is based on several assumptions. Use the IRSs Form 1040-ES as a worksheet to determine your.

Get 3 Months Free Payroll. How to calculate annual income. Here is how to calculate your quarterly taxes.

A Simple Flexible Workforce Solution So You Can Focus on Your Day-To-Day Business. Get 3 Months Free Payroll. Its up to you to fill out and file Form 1099-NEC for every subcontractor you pay more than 600 during the course of the year.

Ad Trust One Platform To Compliantly Pay Independent Contractors. Calculate your adjusted gross income from self-employment for the year. Fast Easy Affordable Small Business Payroll By ADP.

Free Unbiased Reviews Top Picks. Ad Payroll So Easy You Can Set It Up Run It Yourself. The calculators are for illustration purposes only and are based on a series of assumptions.

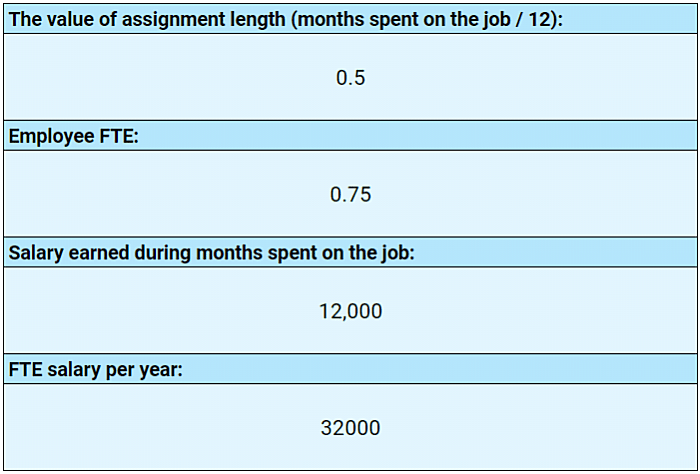

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Heres a step-by-step guide to walk you through. The tools incorporate a range of variables including IR35 and whether you.

Ad Learn How To Make Payroll Checks With ADP Payroll. The calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation but its important to note that this is. Simply input your hourly or daily rate along with the contracts IR35 status to see a comprehensive summary.

Consultants Vs True Cost Of Employees Calculator Toptal

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

Overtime Pay Calculators

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Gross Pay Definition What It Is How To Calculate It Sage Advice Us

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Hourly Paycheck Calculator Calculate Hourly Pay Adp

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

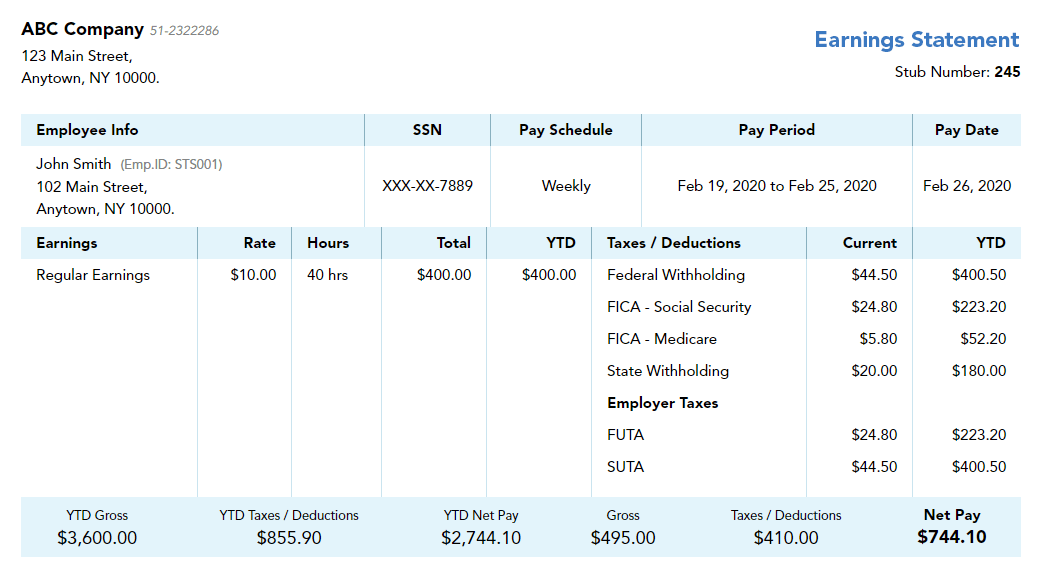

Independent Contractor Paystub 1099 Pay Stub For Contractors

Overtime Pay Calculators

Gross Pay And Net Pay What S The Difference Paycheckcity

/calculate-your-selfemployed-salary.asp-ADD-V1-82a71e14d6d64f2b87f10d03a15a8fbb.jpg)

How To Calculate Your Self Employed Salary

Gross Pay And Net Pay What S The Difference Paycheckcity

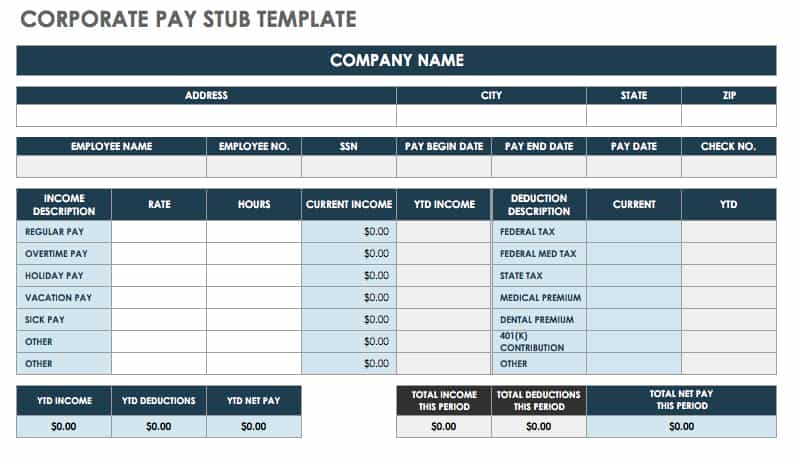

Free Pay Stub Templates Smartsheet

Gross Pay And Net Pay What S The Difference Paycheckcity

Create Pay Stubs Instantly Generate Check Stubs Form Pros

Consultants Vs True Cost Of Employees Calculator Toptal